Metadata

- Author: Tales of Bharat from D91 Labs

- Full Title: Women’s Choice Between Savings and Investments to Gain Financial Freedom

- Category:articles

Highlights

- Savings and investments are two sides of the coin ¹ , the difference being the risk attached to investments. In the past blogs, we have covered how women are risk averse and it is pretty evident even when they make investment choices. While almost all of the women we interviewed expressed the intent to set money aside systematically, only a handful of them actively invest with the intention of growth. (View Highlight)

- Many global studies show that women are often motivated by goal-based savings favouring their family’s well-being (View Highlight)

- after the pandemic, 54% of the respondents - both men and women expressed an inclination to save or invest in an emergency fund. Even our respondents resonate with that - 18 out of the 20 women, have kept aside money in some form or another for emergencies or adverse events. (View Highlight)

- Note: According to survey by Scripbox in 2020

- In most households, the usual savings and investments double up as the emergency fund for future mishaps or unexpected expenses. Despite their intent, only 25% of the women we interviewed have a dedicated bank account or cash reserve set aside for any uncertainties or emergencies that might arise in the future. (View Highlight)

- The thought of saving money for themselves is seen as a selfish act of indulgence among most women. Most of the respondents save for the family, and the children or invest the money back into their business. (View Highlight)

- When asked if they save for themselves, the married women with children said that they don’t, while 2 out of the 3 unmarried younger women said that they set aside a personal care budget that involves shopping for clothes or visiting a spa. (View Highlight)

- The findings from a survey that Zest money conducted among their customers confirm that most women prefer to invest in Gold and Fixed deposits as they are considered less risky ⁴ . But when it comes to gold, women prefer to invest in jewellery rather than bonds or biscuits. (View Highlight)

- Even the Scripbox survey noted a difference in priority between men and women when it comes to emergency funds. A majority of men - 47% prioritized investing for retirement while a majority of women (55%) save for their children’s education. (View Highlight)

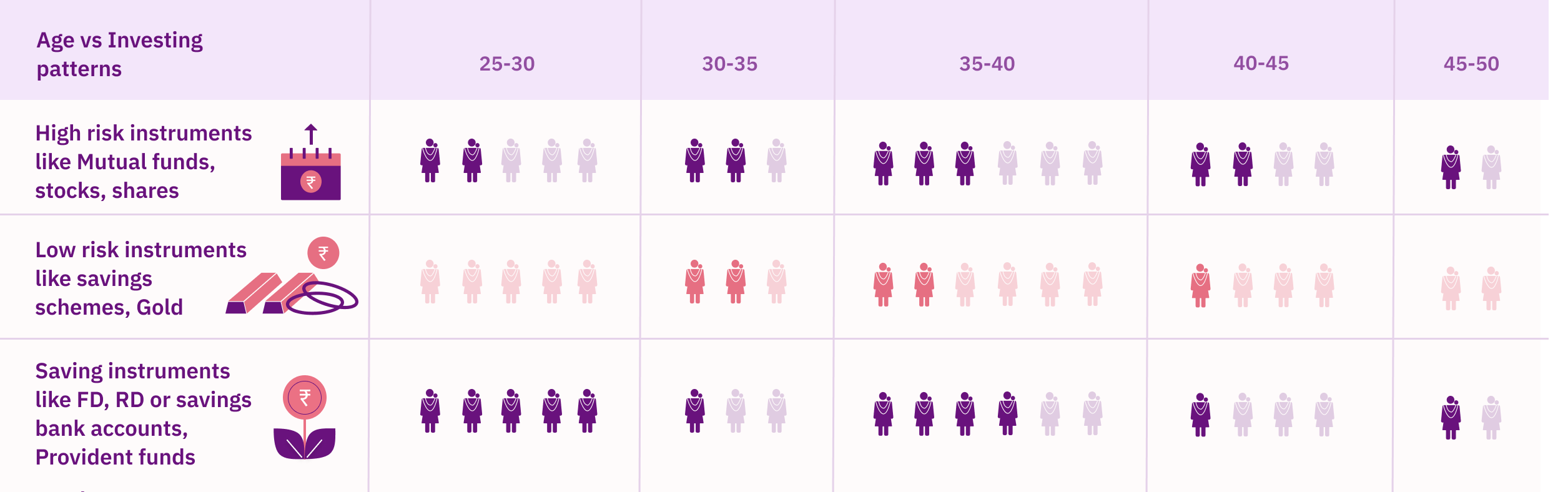

- When it comes to investment and risk-taking abilities, the age of the women plays an important role when making

“I have investments in SIP. Apart from that, we tend to buy gold during Diwali so that’s one part of the investment. I am not a very big fan of gold though. Also, my father invests in Fixed Deposits(FD) and Recurring deposits(RD) since he believes in them more than mutual funds.” - Bhavana , 33 year old Mandala artist from Kolkata

11. (View Highlight)

11. (View Highlight)